Digital Upgrade

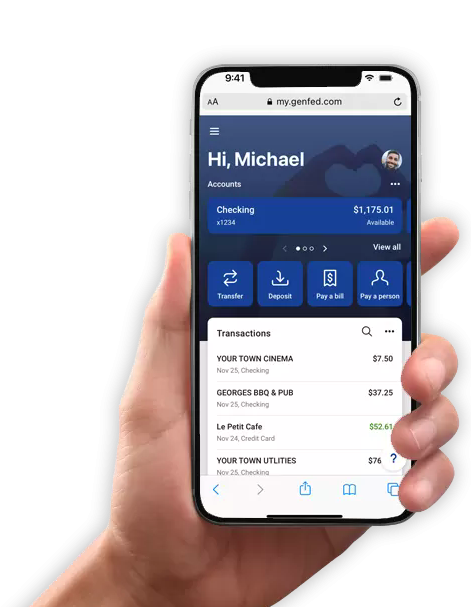

GenFed's New and Improved

Online Banking

Our Commitment to An Excellent Member Experience

We're excited to introduce our new digital banking solution, designed to make managing your money easier and more secure. With a simple and user-friendly interface, you'll find it easier than ever to keep track of your finances. Here's just a few of the features you can look forward to!

Download our new app.

Enrollment for New Users

Need help enrolling into our new digital banking? Make sure to select 'First Time User' to re-enroll. Your old username and password will not work.

When you create your new credentials, you must follow these requirements (if you don't, it may seem like there is a general error (Oops, something went wrong) instead of specifically receiving an error about the credentials you choose):

+Username: Min 8/Max 15 characters, must begin with a letter, cannot contain special characters

+Password: Min 4/Max 20 characters and some special characters can be used-- !"#$%&(*)+,-/;<=>?[\]^_`{|}'

Watch the video below or access these step by step instructions:

Set Up 2-Step Verification

Please Note: The first time you access your accounts online or using mobile banking, you will be required to setup 2-step verification. 2-step verification is an extra security step where you will need to provide a second piece of information, like a code sent your phone number, in addition to your usual banking password. This helps make sure only you can access your account, and it keeps your financial information more secure.

Online Banking

(Web Browser)

-

Visit www.genfed.com and click Login

- Click 'First Time User"

- Enter required enrollment information (SSN/EIN/TIN, member number, email address* and phone number*)

*must be same as those on file with GenFed - Complete 2-Step Verification Process

- Accept User Agreement

Mobile Banking (Apple/Samsung/Android Devices)

-

Download the new GenFed Financial Credit Union app from the Apple App Store or Google Play Store

- Choose the "First Time User" option.

- Enter required enrollment information (SSN/EIN/TIN, member number, email address* and phone number*)

*must be same as those on file with GenFed - Complete 2-Step Verification

- Accept User Agreement

- Creat username and password

- Create 4-digit passcode

- Enable Face ID

Giving a Joint Member Account Access

Once you have signed up for online banking and/or the mobile app, joint members will use the same username and password to access your account.

You have the option to add a secondary phone number for joint members to enable 2-Step Verification using their own phone number instead of sending to the primary member's phone number. Follow these steps or access instructions for mobile with screen examples:

1. Navigate to the menu at the top left of the screen and select your profile name at the bottom.

2. You will then click Personal Settings > Security > Two-factor Authentication > Edit Settings

3. Under Add Another Method, you will select Setup for Voice or Text Messages and enter the joint member's phone number

4. The joint member will then log in to the app on their device using the same credentials as the primary member

5. Once prompted to enter a 2-Step Verification, the joint member will select Try Another Way at which point, their phone number will be provided as a 2-Step Verification option

Account Recovery

Forgot your username or password? Watch the video below to find out how to recover your account:

Bill Pay

Need help enrolling in Bill Pay? Watch the video below:

Mobile Deposit

Need help with Mobile Deposit? Watch the video below:

Make a GenFed Loan Payment from another financial institution, or other transfers into and out of GenFed

With the ending of GenFed's old remote loan payment service, these instructions may be useful in setting up transfers from other banks for your loan payments. The old service is no longer available after 11/30/24. Use these instructions as well to transfer funds from other financial institutions into and out of GenFed.

Need to Know Details

- Any automatic transfers scheduled through online banking, including loan payments, may need to be recreated in the new system. Automatic transfers scheduled through the branch will automatically continue in the new system.

- Loan payments due November 1 - 4: if the payment was scheduled as a transfer through online banking (including re-occurring payments) to be made during the upgrade extended weekend, you'll need to make that payment. Those payments may need to be re-created in the new system as well. If your payment was scheduled to be made with Money Mover during the extended upgrade weekend, it should still have been automatically made for you.

- Any alerts you had set up in the old system will need to be re-established.

- Any bills scheduled to be paid through Bill Payer during the upgrade, November 1 - 4, may not have be made! If you did not re-schedule them before the upgrade, you'll need to pay them.

- Intuit users: You should deactivate and then reactivate your connection. Find details here.

- If you connect to any third party providers, especially Plaid or Plaid-owned apps (such as Robinhood, Venmo, Betterment, Acorns, Mint, and many more) you will need to disconnect and reconnect those apps.

- Moblie operting systems supported: iOS version 16.4 or newer and Android

version 8.0 or newer.

-

Supported browsers: Microsoft Edge - latest version (older versions no longer supported 60 days after a new version is released), Google Chrome - if two versions older than the current stable channel version, it's not supported, Apple Safari - 60 days after a new version is released, older versions no longer supported, Mozilla Firefox - if two versions older than the current stable channel version, it's not supported.

- To use the Safari browser for online banking on your phone or PC it is recommended you disable cookie detection. Within the Safari menu, click 'Preferences' and navigate to the 'Privacy' tab across the modal that pops up. Make sure 'Prevent cross site-tracking' and 'Block all cookies' are unchecked.

What's Different?

- Account types have changed. There is a new 4 digit number for each type. For example, your primary savings will end in 0001 instead of S1. You'll be able to see the full numbers inside online banking. This unique number for each type of account can be used for electronic deposits and withdrawals!

- Check withdrawals from online banking have been replaced with our new transfers option. Or, Bill Pay may be used. Alternatively, you can call your branch.

- Remote Deposit is now Mobile Deposit! If you were enrolled in Remote Deposit on the old system, you will be enrolled in Mobile Deposit. However, if you want to use the new feature allowing you to deposit into additional share types, each type will require a request.

- For direct deposit or other electronic transactions, you now have a special account number for each of your deposit accounts. This number can be found inside online banking under the details for the specific account you want to use. You can still use just your member number for automatic transactions.

- Joint members can create their own log-in after the primary member has set up their log-in!!

- Zelle person-to-person payments and enhanced bill pay where you can choose which account to pay from, plus set up payments from biller's statements

- Small businesses: QuickBooks plug is available

- Everyone: get Intuit connectivity for Quicken

- Receive immediate credit on Remote Deposit

- Account Alerts are enhanced with merchant name (instead of just amounts)!

- The iPad app is supported again

- Account numbers will remain unmasked inside the app

- You have the ability to transfer money into or out of GenFed for loan payments or savings from/to an outside FI.

- Seamless connections to eStatements, Bill Pay, and credit and debit card information and controls

- Activate credit and debit cards, place travel notices, make balance transfers (credit cards), change PINs, order a digital replacement or report your card lost/stolen all from the upgraded new app!

- Improved experience for opening a second savings or investment account

- Set up a Bill Payer alert to be notified that your payment is being sent!

Friday November 1, Saturday November 2, Sunday November 3, and Monday, November 4, 2024

Online banking and FREDI will be unavailable starting at 2 PM Eastern on Thursday, October 31.

Bill Payer will be closed from Monday, October 28 - Monday, November 4.

What to expect:

-

You now need to re-enroll in online banking

- Also remember to download the new app and re-enroll in mobile banking (delete your old apps! yay!)

- Deposits may take longer than normal to process to your account for a little while.

- Anticipate longer than normal wait times as we resume normal operations. High call volume is expected and voice mail will be unavailable as we continue putting the final touches on our upgrade for a better member experience.

- Our employees have been working overtime and we apologize for any service interruptions you may experience. Thank you for your patience. We’re confident our new systems will be worth it as we all work together to Build our Bright Futures with Heart.

Digital Upgrade FAQs

Account Information

No, the account/member number will remain the same and will continue to be the primary way to access your account information. Additionally, GenFed's routing number will remain the same.

No, shared branching transactions will not be available during the upgrade period.

Night drop and mailed deposit received during the upgrade should be on or after November 5.

There should not be a delay in the October statement.

No, your account history will continue to be available just like it is in the old system

Yes, there will be changes to the layout of the data on your November statement. While it will be designed to be user friendly, you can contact GenFed any time should you have a question about the new layout.

On October 31, 2024 we will say good-bye to FREDI as we know him. Please join us in a moment of silence in his honor.

However, a new voice banking sytem should be rolled out during this upgrade time, or shortly after! The new system is a virtual assistant and should be much more intuitive than FREDI ever was. New technology will be used to help you make transactions with the prompt of your voice. We're very excited for our touch-tone teller to be catching up with the 21st century!

No, you will only need to enroll in either the app or the desktop.

Yes! You’ll have access to your archived eStatements (up to a 12 month timeframe based on when you enrolled), just like you do now.

Any automatic transfers scheduled through online banking, including loan payments, will need to be recreated in the new system when it's available, after November 4. Automatic transfers scheduled through the branch will automatically continue in the new system.

Any alerts you have set up in the current system will need to be re-established after November 4.

Checking / Debit / ATM

Yes, and please note that GenFed will be in an offline mode and there will be certain limits.

Checks that don't clear before GenFed goes into offline mode on Friday, November 1 will clear when the upgrade is complete.

You can continue to use your current debit card and checks through the upgrade and beyond. Your account and routing numbers will remain the same. Your debit card PIN will remain the same.

Yes, and please note that GenFed will be in an offline mode from Friday November 1 through Monday, November 4. Both cards should continue to work within certain limits. Please plan ahead so you can be ready in the event you make a larger purchase during this period.

Please contact our support service centers:

- To report a lost or stolen MasterCard credit card, please call 866-820-3844.

- To report a lost or stolen STAR debit card, or for 24 hour debit card support, please call 888-918-7853.

No. GenFed will be in an offline mode, there will be certain limits, and the balances shown may not be reflective of your true balance.

Make sure your debit / credit cards are unlocked in the GenFed Cards App on October 31, otherwise you may not be able to unlock them in the new system and your transactions will be denied.

Please activate any new or re-issued debit and credit cards immediately upon receiving them as activation will not work during the upgrade weekend.

Bill Pay

You'll have a calendar view available, can use Quick Pay to pay everyone from one screen, can set up rules to alert and pay or not pay, and trace number is available. If your payment is sent via check you'll get tracking information.

Please plan ahead and schedule bills to be paid before the upgrade starts.

Bill Payer will be closed from Monday, October 28 - Monday, November 4.

Any payments you schedule during this period will not be made. If you hve paid a bill after March 1, 2024, your billers will be moved to the new Bill Payer system.

Any bills scheduled to be paid during the upgrade will not be made! Please reschedule them to ensure prompt payments. If you haven't had a bill payment since 3/1/24 you will need to re-enroll in Bill Payer on or after November 5. Reminders do not count as a payment.

Bill Payer will be closed from Monday, October 28 - Monday, November 4.

Please plan ahead and schedule bills to be paid before Monday, October 28. Bill Payer will be unavailable during this time and any payments you schedule during this period will not be made. If you have paid a bill after March 1, 2024, your billers will be moved to the new Bill Payer system.

Loans / Credit Cards

Plan ahead and make any loan payments that are due between November 1 - November 4 ahead of GenFed going into off line mode on November 1.

If the payment has been scheduled through online banking (including re-occurring payments) to be made during the upgrade extended weekend, you'll need to make arrangements for your November payment which may include making your payment early, or waiting to make the payment on November 5. Those payments will need to be re-created in the new system after 11/4. If your payment is scheduled to be made with Money Mover during the extended upgrade weekend, it will still be automatically made for you.

Yes, and please note that GenFed will be in an offline mode from Friday November 1 through Monday, November 4. Both cards should continue to work within certain limits. Please plan ahead so you can be ready in the event you make a larger purchase during this period.

Please contact our support service centers:

- To report a lost or stolen MasterCard credit card, please call 866-820-3844.

- To report a lost or stolen STAR debit card, or for 24 hour debit card support, please call 888-918-7853.

Make sure your debit / credit cards are unlocked in the GenFed Cards App on October 31, otherwise you may not be able to unlock them in the new system and your transactions will be denied.

Please activate any new or re-issued debit and credit cards immediately upon receiving them as activation will not work during the upgrade weekend.

General

To facilitate the system upgrades, GenFed will be closed Friday November 1 through Monday, November 4, 2024.

Online banking (app and online) will be unavailable during this time as well.

GenFed will reopen with new systems on Tuesday, November 5, 2024.

This will not affect your accounts in any way, other than an extended closure from November 1 through November 4. GenFed will reopen on Tuesday, November 5. On or after that date you will need to re-enroll in online banking.

During that period the old online banking system will be unavailable. However, your debit and credit cards will continue to work and most direct deposits should be available for withdraw / access as usual.

Your account/member number will not change and no action is required to ensure transactions continue to clear on your accounts after November 5.

Yes. We the safety of your data is a top priority. Please be assured that throughout this upgrade process, we are taking extensive measures to ensure that your data remains secure and protected. Our team is following industry best practices, including robust encryption, advanced security protocols, and continuous monitoring to safeguard your information.

The safety of your money is a top priority for GenFed. Please rest assured that your funds are fully protected and secure during this upgrade process. Our credit union is committed to maintaining the highest standards of security and privacy.

Your deposit accounts are insured up to $500,000 through a combination of $250,000 of primary insurance from American Share Insurance and $250,000 of excess insurance from Excess Share Insurance Corporation. Each account you have with GenFed is insured individually (savings, checking, certificate, etc.) and there is no limit to the number of accounts you may have to maintain this level of coverage. Also, individual and joint accounts are insured separately. For example, say you have an individual account containing $250,000, and a joint account with your spouse containing $250,000. Each account is insured separately for a total coverage of $500,000.

Yes! GenFed is decreasing fees! There are some very nice changes beginning on November 1. The fax fee, wire tracing fee, deposit item returned unpaid causing negative account fee, and coupon collection fee are all being removed.